Aarya Loan Automation System

Products

Information

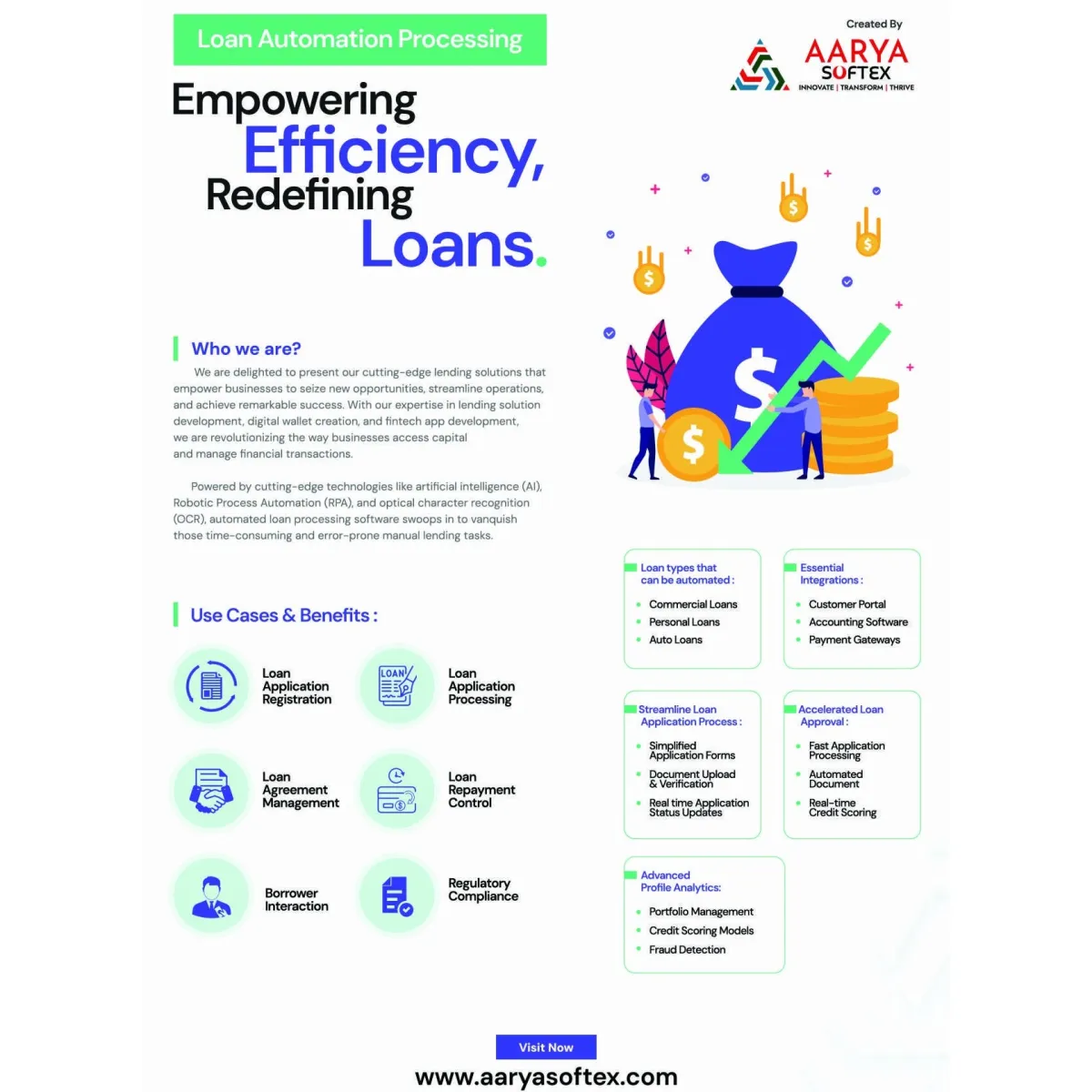

A Loan Automation System powered by Blockchain and Artificial Intelligence (AI) revolutionizes the traditional lending process by making it more secure, efficient, transparent, and customer-centric. This advanced system leverages cutting-edge technologies to streamline loan management, reduce fraud, and ensure faster decision-making.

Key Features:

Blockchain Integration:

Immutable Ledger: Secure storage of borrower data, loan agreements, and transaction history.

Smart Contracts: Automates loan disbursements, repayments, and compliance checks, reducing manual intervention.

Transparency: Ensures all stakeholders (borrowers, lenders, auditors) have access to tamper-proof records.

AI-Powered Loan Processing:

Credit Scoring: AI analyzes financial history, social data, and behavioral patterns to assess creditworthiness accurately.

Automated Decision-Making: Real-time loan approval or rejection based on AI-driven risk analysis.

Fraud Detection: Machine learning algorithms detect anomalies and flag potential fraudulent activities.

End-to-End Loan Lifecycle Management:

From application and approval to disbursement and repayment, the process is fully automated.

Personalized loan terms based on AI recommendations tailored to borrower profiles.

Enhanced Customer Experience:

24/7 Chatbots: AI-powered virtual assistants provide instant query resolution and updates.

Faster Approvals: Applications processed in minutes rather than days.

Self-Service Portals: Borrowers can track loan status, EMIs, and repayment schedules.

Regulatory Compliance:

Blockchain ensures compliance with financial regulations by providing auditable records.

Automated reporting tools simplify adherence to local and international lending standards.

Cost Efficiency:

Reduces operational costs by minimizing human intervention.

Optimizes resource allocation and speeds up processing times.

Product Category

FinTech